The Supply Chain in Retail: Advocacy for a Return of Shelf Space to the Heart of the System

Are we facing a rate of structural failure? Can we go further to improve the availability of products on the shelf? Traditional brands are asking themselves more than ever the question at a time when, to face increased competition from online distribution, the answers until recently consisted in offering wide product ranges and in immediate availability. .

In 2011, a study by ECR concluded that the average rate of actual product availability in national large-scale retailers was less than 90%. This figure is surprising and yet France is no exception, since similar studies carried out in the United States reach relatively similar conclusions, with an average 8% failure rate (Corsten and Gruen 2003). Even more surprisingly, this figure has changed very little despite the technological tools and resources invested. Thus in 2008, a report commissioned by the Coca-Cola company reported a breaking level of 8 to 9% … a rate identical to that observed 12 years earlier.

Re-mobilize Stores on Supply Chain Issues

We are very far from the service rates known in the industry, but also from the performance of the warehouses of these same brands, which display an average of 99% availability. How to explain and reduce this gap The first of the challenges is to align the Supply Chain and Commerce with this observation. Indeed, when we ask store managers about their level of product availability, the figures announced spontaneously are far from the reality observed on the shelf. The failure rate is generally underestimated, and even more so is the associated loss of turnover, because our interlocutors assume an almost systematic transfer to other products. However, a survey conducted by Danone revealed that, in almost half of the cases, the customer preferred to do without the product or buy it from a competing brand. To the credit of store managers, few Supply Chain reports incorporate this notion of shelf availability. Indicators often stop at platform availability and on-time delivery to the store. But what about real customer service? If there is agreement that the role of the Supply Chain is to deliver the right product at the right time to the right place, the performance indicators should focus on the one place where the products are really needed: the shelf. And yet the OSA (“On-Shelf Avalaibility”) is an indicator that is still not very present in the dashboards of the distribution Supply Chain.

Failing to be measured by the distributor’s central Supply Chain, in-store outages are most often the subject of field surveys, carried out by the sales teams.

Field Supply Disruption Records: 2 Major Limitations

1 / The Field Readings Do Not Allow to Calculate the Actual Rate of Breakage of the Store

- These relatively time-consuming readings cannot be carried out on 100% of the store benchmark,

- Carried out at a frequency defined upstream, they give a photograph of the breaks but do not allow their duration to be known,

- Finally, usually carried out in the morning, during low traffic hours and often just after restocking operations, their relevance can be seriously questioned,

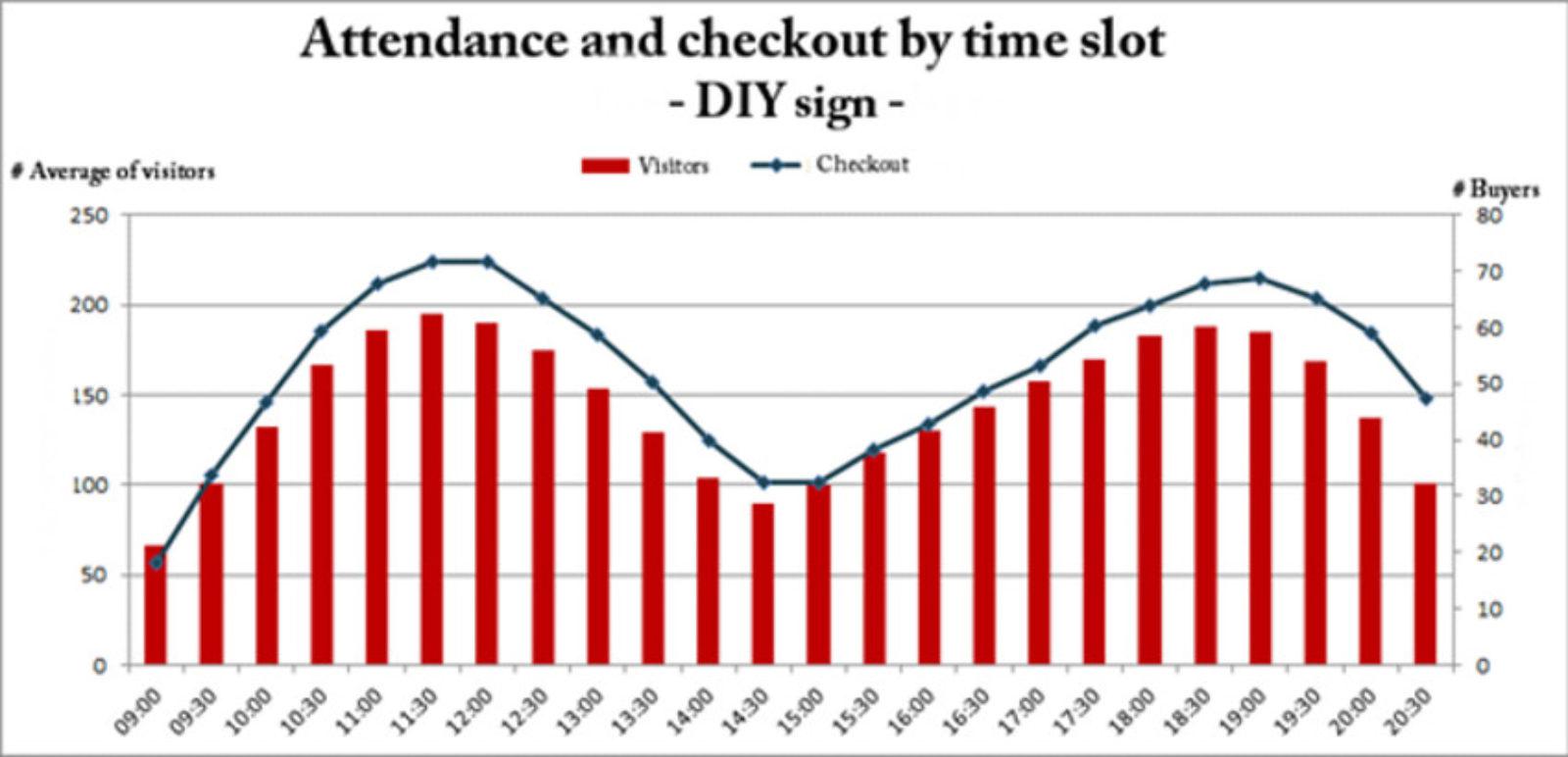

- Most stores are indeed frequented by camel back (see illustration below), with increased traffic at the end of the day. Thus, breaks at the end of the day potentially represent a higher loss of turnover for distributors than those identified (and corrected) during the morning.

2 / These Breakage Reporting Operations are Insufficiently Supervised and Used in Stores

During this operation, the store employee will try to optimize the “facing”, and potentially verify the presence of the product in reserve. When working with our customers, we work with operational teams on building a simple resolution tree to help them leverage system information to locate merchandise. From there, we have the keys to understanding and treating the root causes of ruptures. These analyzes often surprise the stores, which too easily make the plant take responsibility for the failures.

Build a Field Action Plan

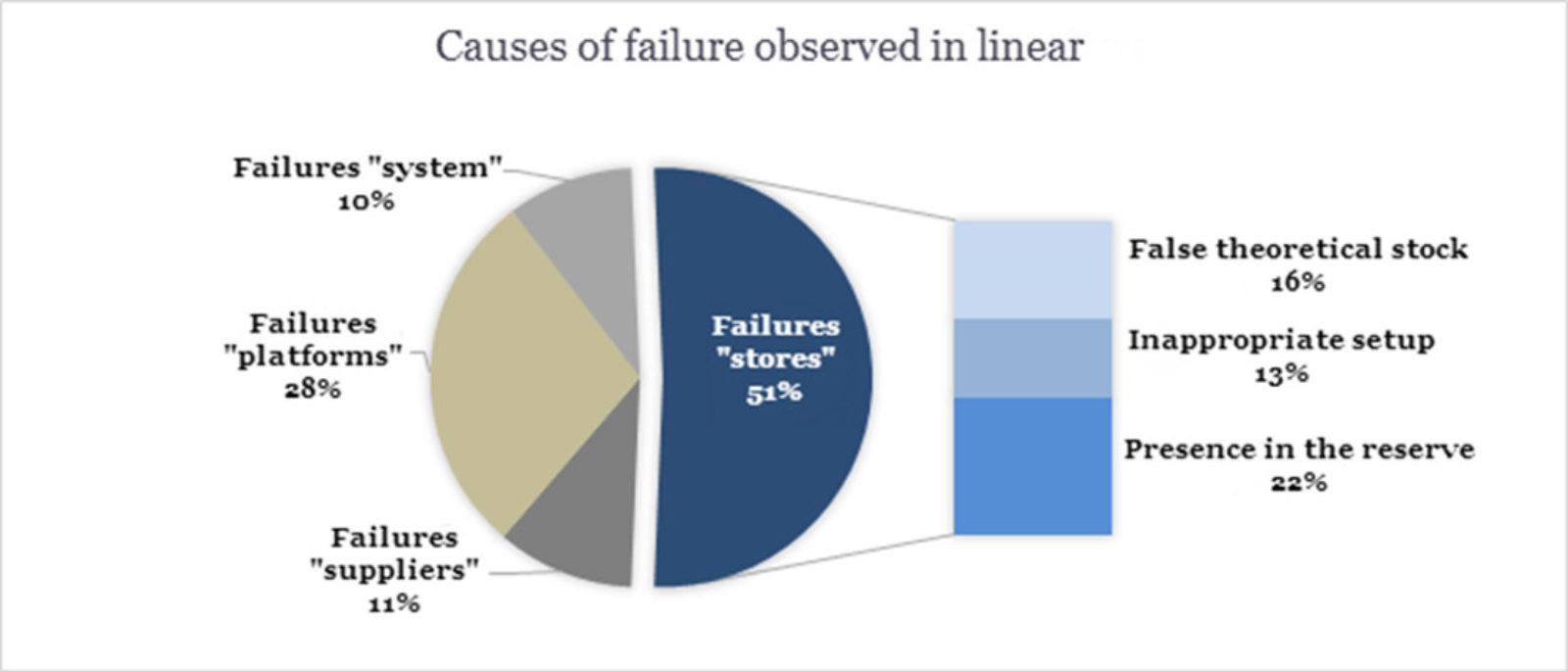

Empirically, we see that 50 to 60% of shelf-life breaks depend directly on in-store operations, the rest of the shortages being linked to the upstream Supply Chain (supplier and / or platform failure).

Among the errors attributable to stores, the following are the most common mistakes that need to be brought under control:

- Wrong theoretical stock, thus preventing any triggering of restocking

- Setting of the quantity on shelves (facing and depth on shelves) not suitable

- And finally, cream pie subject but which still represents a strong potential for improvement for the brands, the product present in reserve but which has not reached the shelf.

We experienced this with a hypermarket chain whose stores complained of an “auto-order malfunction.” The conclusions of the analysis carried out in the field confirmed this rule (see the summary of the causes of ruptures observed below):

It’s a fact: products often travel thousands of kilometers without worry, only to get lost in the meanders of the last few meters in the store. The flow of goods and information is under control until the gates of the reserve, it is then up to the organization to take over.

What Operational Solutions to Avoid Pitfalls in Stores?

Some brands, with the support of industrialists, are developing tools to include linear in their overall vision of flows, RFID undoubtedly being the most popular. A survey carried out in October 2015 among distribution professionals confirmed that 63% of the companies surveyed were in the process of studying or deploying the solution. However, for the moment, the solution is only operational in 6% of organizations … So until we have an RFID chip in each pie box, what do we do?

It would be utopian to rely on improving customer service on technology alone. For example, some electronic labels that include logistics information (available stocks, work in progress, etc.) have not had a significant impact on the product availability rate. While access to information is faster, it is still necessary to know how to use it effectively. It is therefore necessary to work with the operational teams to set up effective processing of information. 2 lines of thought should be favored:

1 / The Need to Review the Processes

Receipt of merchandise, restocking on the shelf and more generally throughout the day in stores.

A store’s reserve often looks like a black box, which generates either overstocking or breakdowns. It is essential to revisit the organization of this area to make it a transit area and not a storage area. The reconfiguration of the reserve is often a prerequisite for optimizing the provision and management of the activity by department managers. Whether the store has dedicated restocking teams or mobilizes sales staff during off-peak hours of the day, the challenge remains the same: to ensure that information and merchandise circulate efficiently between the store and the floor area. sale.

2 / Strengthen Managerial Guidance

… for a redefinition of missions and improvement of in-store practices.

These levers are known and yet neglected. The reliability of stocks remains a major issue and largely depends on the stores. The management of promotional purposes, the monitoring of breakage and markdown, checkout practices, are all in-store operations that impact the reliability of stocks. Obviously the lack of resources is one of our customers’ first arguments to justify the unreliability of their stocks. We then work with them to develop a logistics system differentiated by type of product and customer. Which customer profile visits the store when it opens: professionals or individuals? What are they buying? What are the priority issues in terms of margin? Differentiation from the competition? It is about starting again from the priorities of the trade to define the best possible allocation of the available logistic resources. These good practices for managing performance in differentiated flows are widely used in the Supply Chain professions, but they are still often lacking when one penetrates the perimeter of the sales area.

3 / Developing the Distribution Professions

In terms of optimizing the Supply Chain, we can only congratulate ourselves on the development of IT systems that allow transversal and centralized management of supply flows. However, these tools should not limit the responsibilities of the department manager, but on the contrary, allow him to position himself on issues with higher added value for the Supply Chain. The time freed up on placing orders (what, how much, when?) Must be reallocated to the calibration of stocks (configuration of the need) and to the overall management of flows over the last few meters.

Any technological change, such as that operated by distribution brands in their Supply Chain, must be accompanied by changes in the professions. In distribution, the explosion of the offer (referencing multiplied by 2 on average over the last 15 years) and the pressure on costs to which brands are exposed pose many challenges for organizations. The shelf is no longer just a place to showcase products and sell, but also a place of storage. The professions of the sales teams must therefore evolve accordingly and the brands must adapt their organization to this change.