GMROI Indicator: Cash Gains in Sight for Retail and Distribution

Better Integrate “Cash Flow” Into Decision-Making

When a distributor wants to optimize his operating cash flow, he most often thinks of reducing his inventory and negotiating longer payment terms.

The improvement in Free Cash Flow that can be achieved through this approach is limited and short-term for three reasons.

First, extending payment terms is a relatively weak lever. In fact, payment terms are most of the time already at the legal maximum and their lengthening generally results in an increase in purchase prices by the supplier.

Second, and most importantly, this approach does not integrate the margin dimension into the equation. However, the margin level is one of the most impacting levers on the “cash health” of a distributor.

Finally, and this is related, the decline in inventories can be counterproductive on cash flow if it is done to the detriment of sales and therefore of the mass of margins.

It is therefore by jointly optimizing cash “generated” by the margin and cash “immobilized” by stocks that a distributor can truly optimize its cash flow over time.

And that’s where the concept of GMROI comes into play.

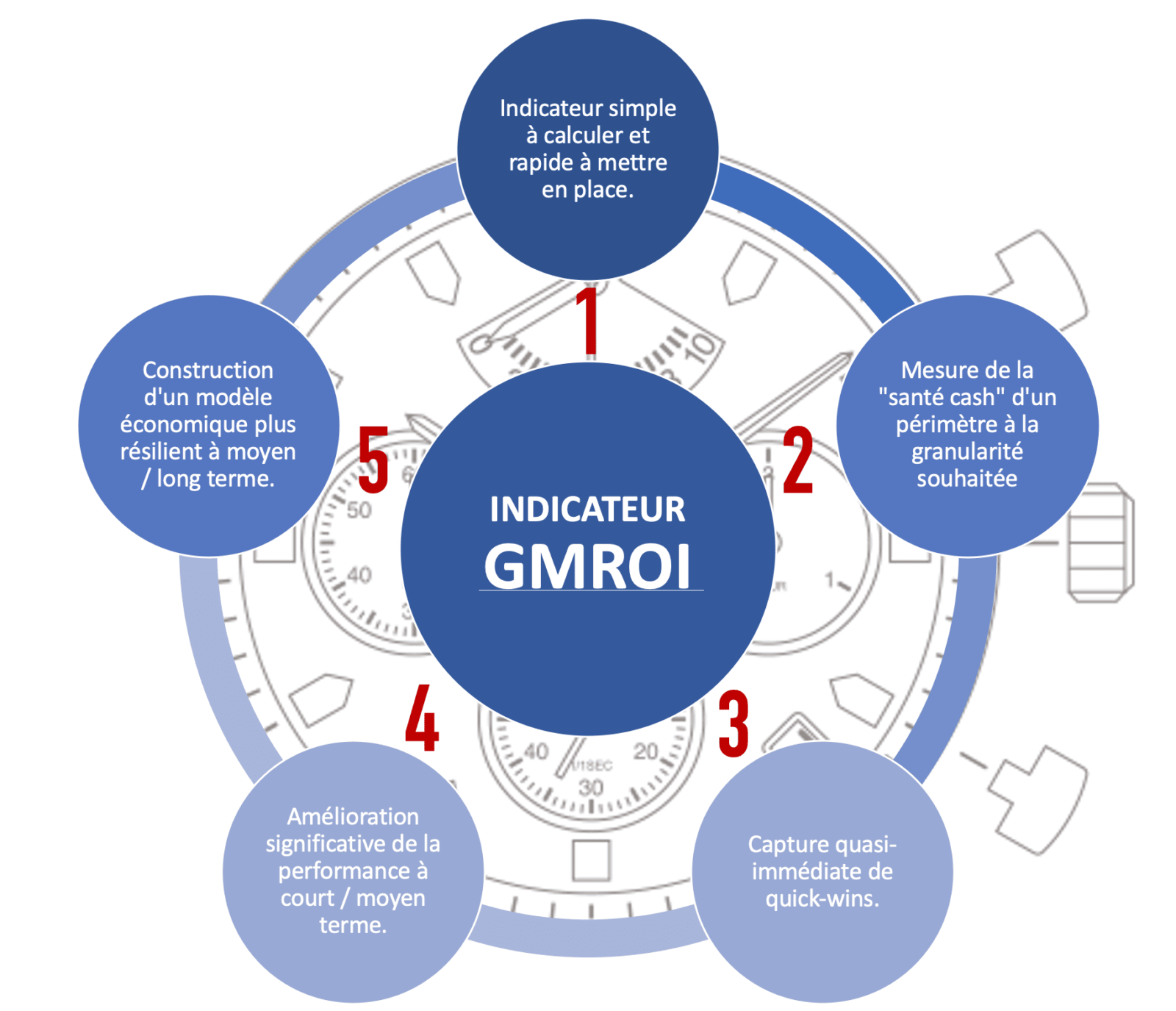

The 5 Strengths of the GMROI Indicator

An Essential Indicator for Those Who Use It

We may be surprised that the GMROI is not used by all distributors. It is the only indicator that integrates both margin and inventory, which allows teams to make the right trade-offs operational.

An Indicator Appreciated by Shareholders ...

A shareholder will always listen if you tell them about GMROI and CAPEX. Indeed, these are the two operational indicators to follow to optimize Free Cash Flow: GMROI to optimize cash flow from operations and CAPEX to control cash flow from investments.

... and Franchisees

A franchisee is always very sensitive to stock because it is his money that he puts on the gondolas. The GMROI is therefore a great tool for discussing the actual performance of a concept with franchisees.

GMROI: An Indicator That is Simple to Calculate and Quick to Set Up

GMROI is the acronym for “Gross Margin Return On Inventory”

The calculation and appropriation of the indicator by the teams does not pose any difficulty. The time required to obtain the indicator is limited to that of data collection.

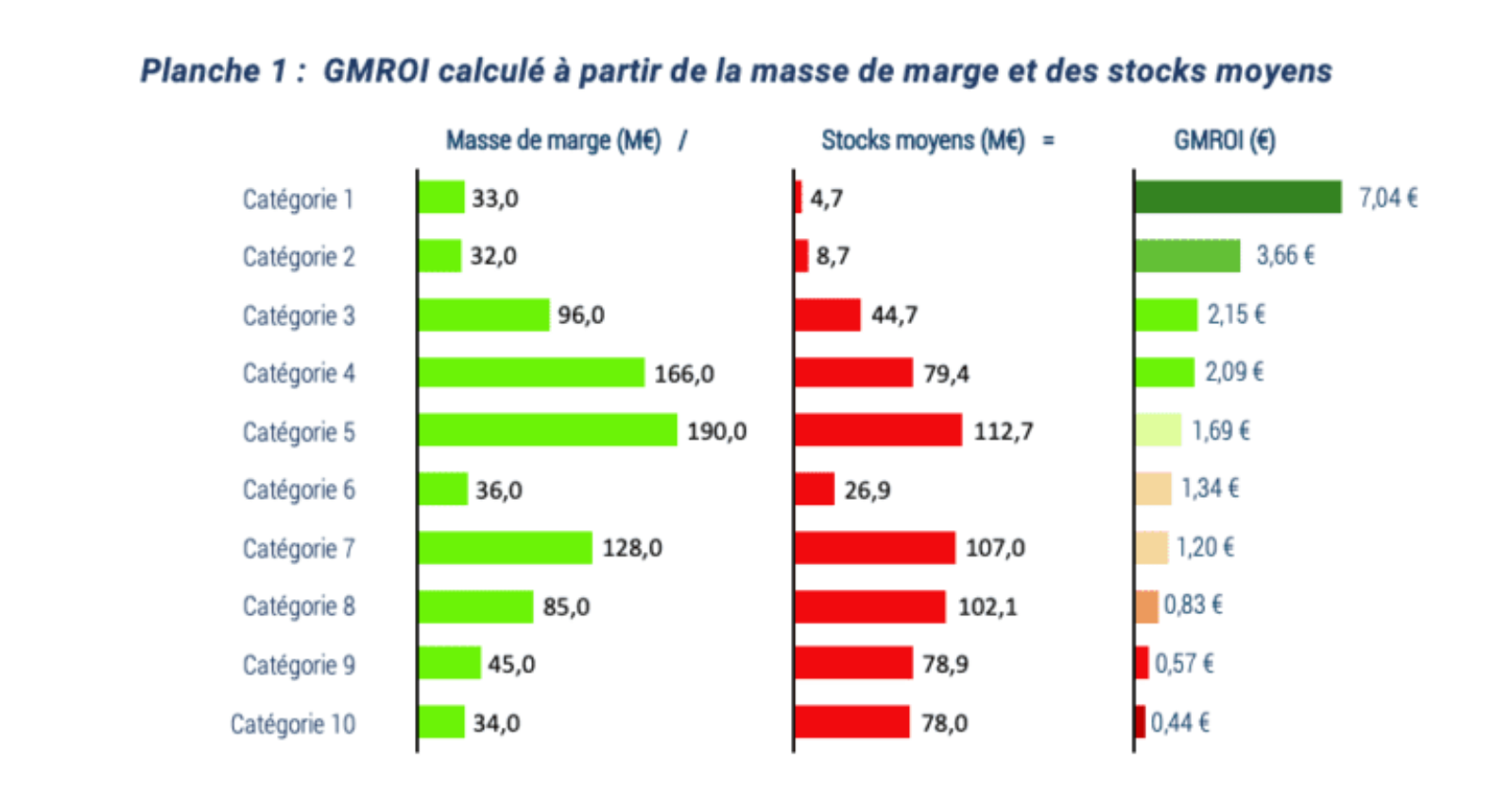

The GMROI corresponds to the margin generated by each euro of average immobilized stock.

In the example of Plate 1, Category 1 has a GMROI of € 7.04: each euro of average stock generates € 7.04 of gross margin annually.

After decomposition and simplification, the GMROI depends directly and only on two parameters:

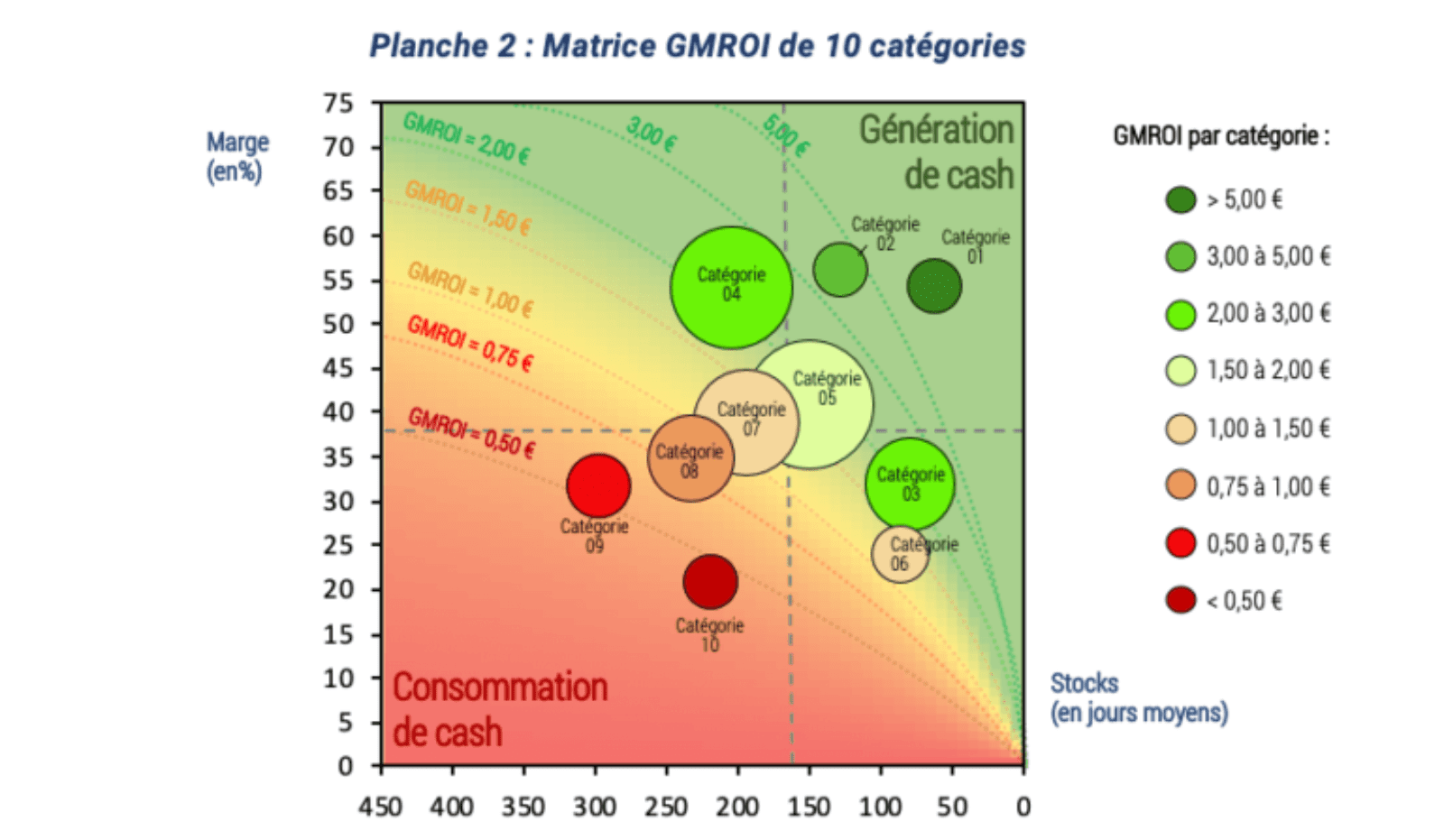

the margin level (as a % of turnover) and the level of average stocks (in number of days of rotation). Plate 2 positions the same categories according to these two parameters:

This graphic presentation allows us to get out of the Manichean vision of margin and stocks.

More stocked than Category 5, Category 4 nevertheless has a better GMROI thanks to its much higher margin rate.

A Ratio that Measures the "Cash Health" of a Scope at the Desired Granularity

The Virtues of a Ratio

As for the margin rate or the stock in rotation days, the GMROI is a ratio, which allows

compare perimeters of different sizes.

It is possible to add the size of the perimeters in the analysis using the mass of the margin to determine the size of the bubbles in the GMROI matrix. Thus parameterized, the matrix gives a complete vision of the performance as in Plates 2 and 3.

The Concept of Health Cash

The GMROI aggregates the two most impactful cash indicators on operating cash flow: the cash generated by the margin and the cash immobilized by inventories. It therefore reflects the “cash health” of a business model with constant distribution costs and Capex.

It reflects the ability of a business to generate excess operating cash flow to finance distribution costs and investments.

An Analysis at the Desired Granularity

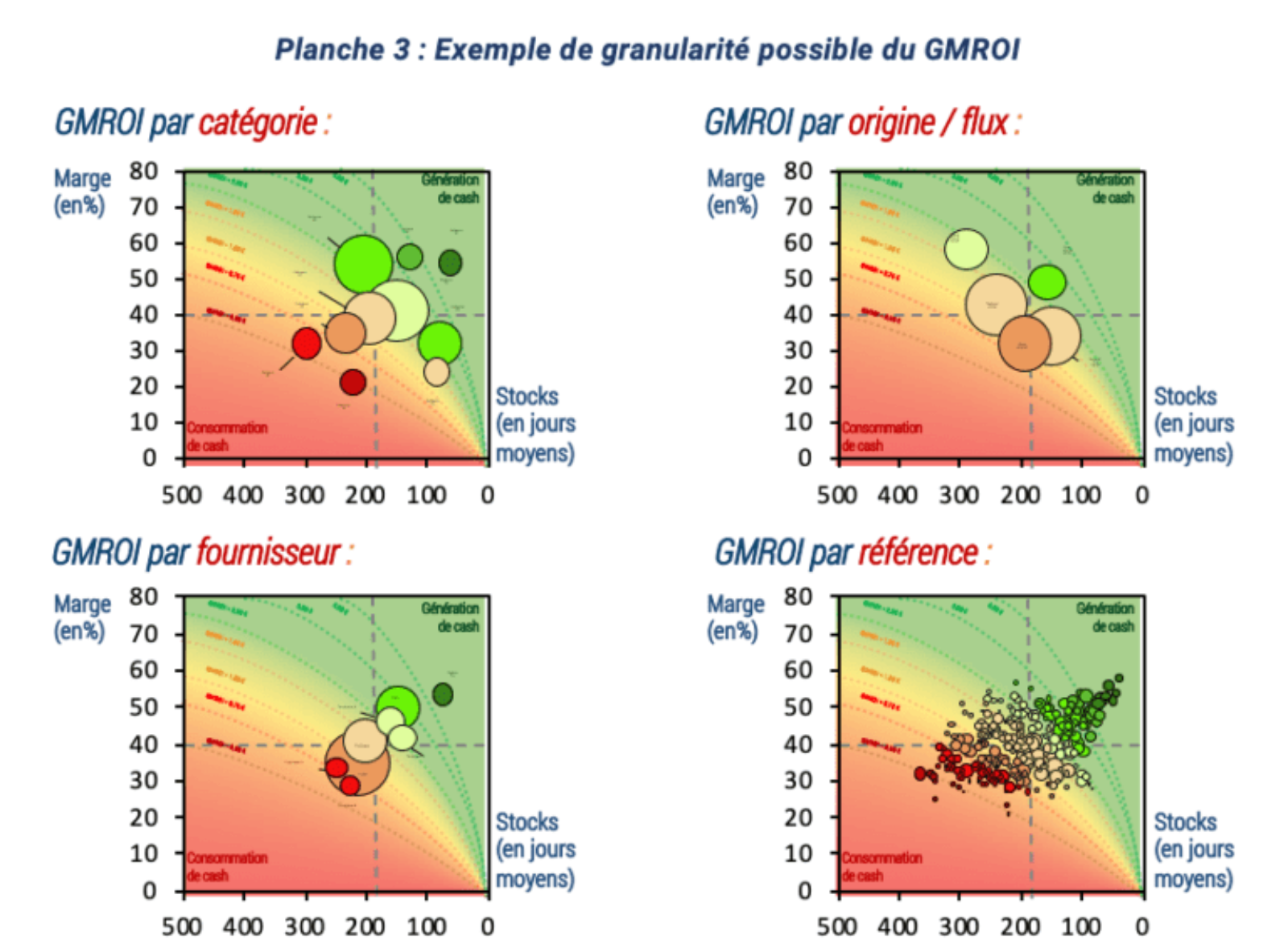

The GMROI can be calculated at the desired granularity, thus making it possible to compare the “cash health” of relatively large perimeters (GMROI by department) or on the contrary to obtain insights at a very fine level (GMROI by reference).

Plate 3 shows the 4 levels of granularity of GMROI frequently used. Others are possible, in particular to analyze the performance of points of sale (GMROI by brand, by type of store, by region or by catchment area, etc.).

Arbitrations Made Possible

Thanks to its great versatility in terms of granularity, the GMROI makes it possible to make better operational arbitrations and to optimize the allocation of resources. Indeed, it helps to inform many decisions with quantified and cash-oriented elements.

What are the spokes to grow? What are the categories where the enemy N ° 1 is the rupture and those where the attention must mainly be paid to the surveillance of the stocks? What difference in the purchase price should I have to justify switching to large import or, on the contrary, to close sourcing?

An Almost Immediate Capture of Quick-Wins

Following the implementation of the indicator, the first gains are generally identified and captured in the very short term. In general, the only joint visualization of the level of margin and the level of stocks leads in effect to immediately consider the first corrective actions. While these quick-wins usually only represent around 15% of earnings, they alone justify the implementation of GMROI and have the merit of quickly leading teams to action and early wins.

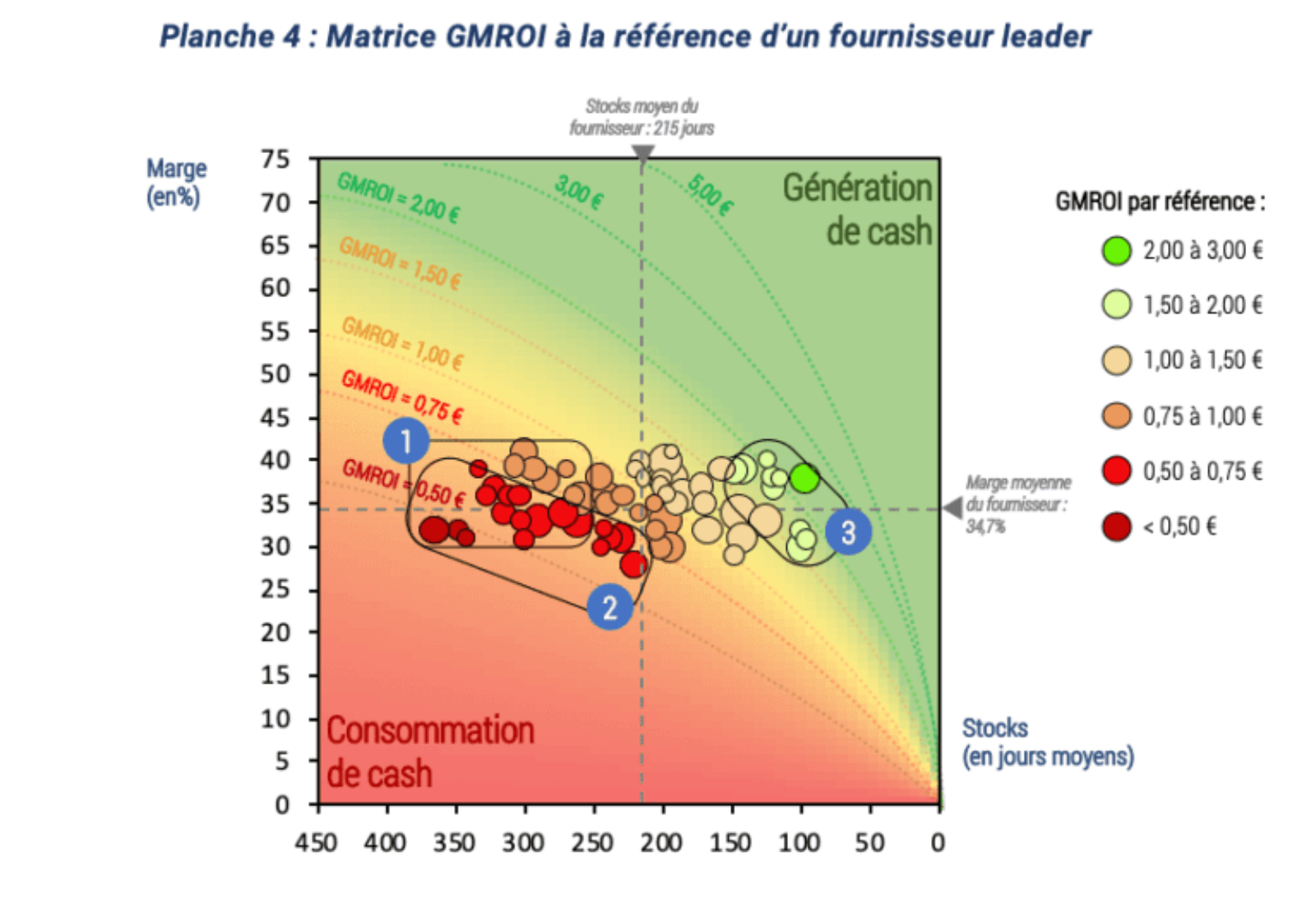

Three types of corrective action are generally responsible for these quick wins. These quick-wins are often identified through the GMROI benchmark analysis. Indeed, it is at this level that one can make very quick decisions, without having to conduct a lot of additional analyzes. The example on Plate 4 shows the GMROI of 65 references from a leading supplier in its category.

Noting the heterogeneity of GMROI performance of this supplier’s references, the sales teams immediately took 3 corrective actions and captured almost immediate results:

Ad hoc negotiation of supplier contribution to good product flow. In the example above, flow solutions were negotiated for the 21 SKUs with more than 250 days in stock.

Targeted changes in assortment nationally or by type / area of store: The immediate stopping of restocking and de-listing were decided for the 19 references with a GMROI of less than € 0.50, after checking the substitutability of these references with other references remaining in the assortment. It should be noted that these decisions have made the approach credible with the supplier.

Adjustments to ordering and restocking parameters: These adjustments made it possible to stop and / or limit purchases on certain products, but also to eradicate outages on the products that generate the most cash. In our example, a prioritization of restocking and increased vigilance on breaks was decided for the references with a GMROI greater than € 1.50 (10 references in the case of this supplier).

A Significant Improvement in Performance in the Short / Medium Term

After capturing the first quick-wins, the GMROI allows substantial gains in the short and medium term if it is integrated into the first annual trading campaign which follows the implementation of the indicator. About 35% of the total gains can thus be captured in 3 to 12 months.

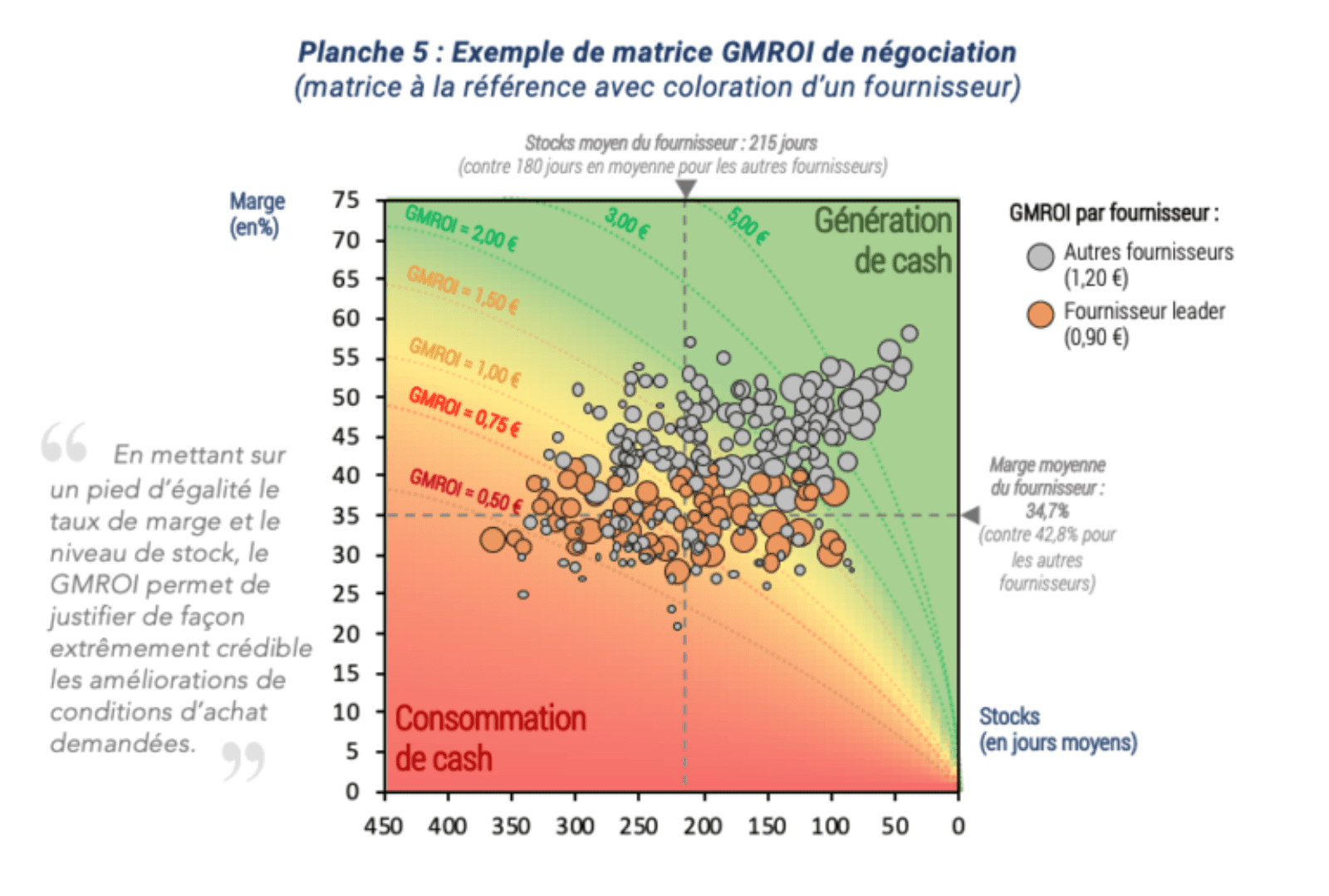

Plate 5 illustrates the type of tool that a buyer can use in the box during their negotiations. Here again, it shows the GMROI of the leading supplier by reference, but this time accompanied by that of the references of the other suppliers. The buyer’s power of conviction will be all the greater as the first quick-wins have already led to product de-listing for this supplier.

3 Conditions Necessary for the Success of the Negotiation Phase:

- Solid preparation of negotiations based on factual quantitative elements,

- Flawless support for negotiators by top management

- Real ability to change the sales mix and therefore the post-negotiation purchase mix.

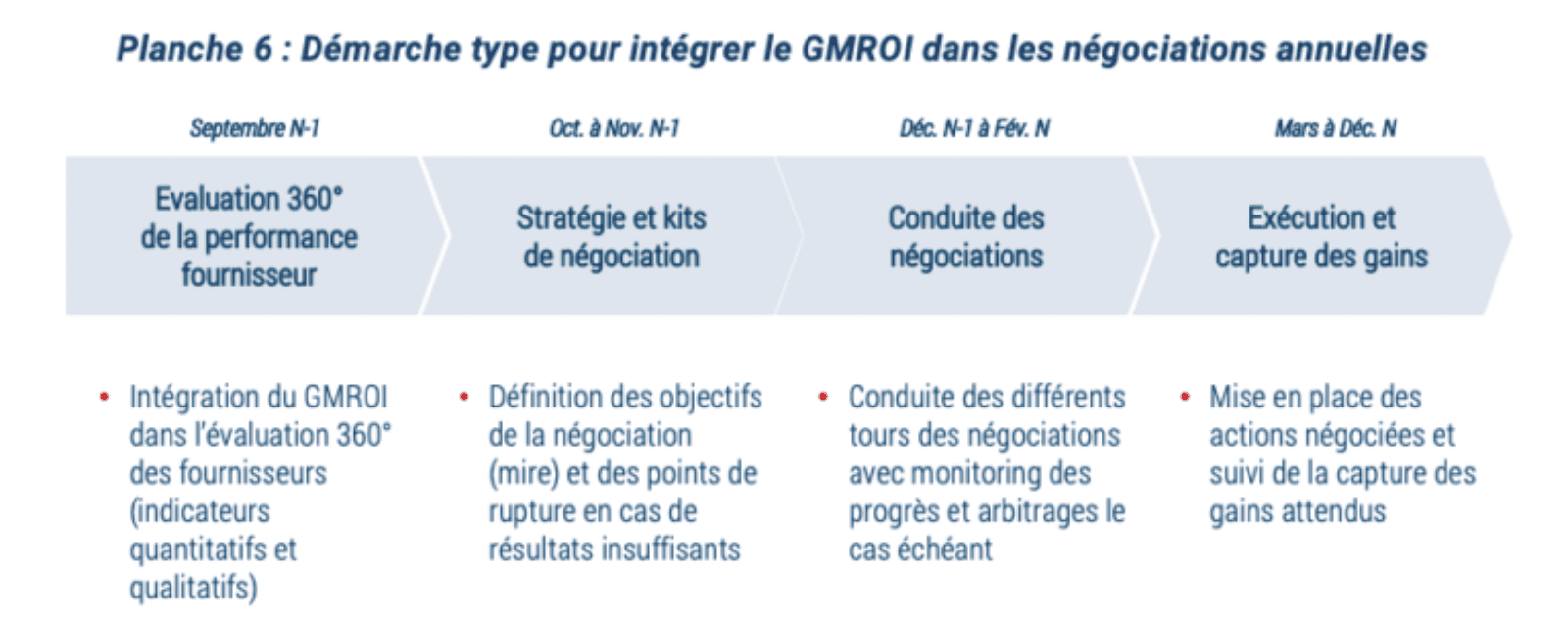

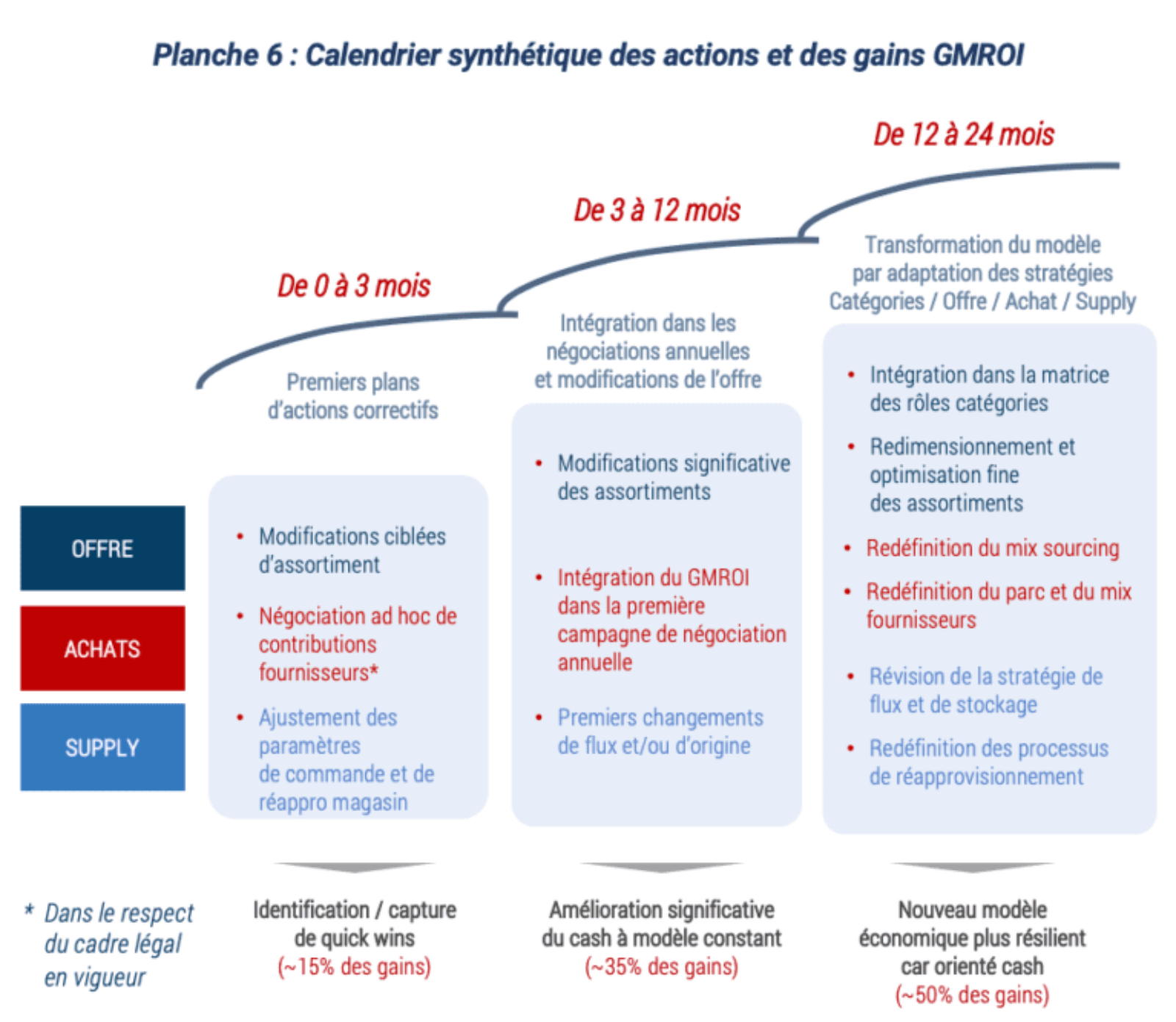

Plate 6 outlines the steps and timeline for successfully integrating GMROI into negotiations:

Building a More Resilient Economic Model in the Medium / Long Term

Beyond the quick wins and the gains of a successful trading campaign, the GMROI can also be medium / long-term value creator if it is integrated into the company’s strategic decisions. With about 50% of earnings over 12-24 months, the GMROI makes it possible to increase the resilience of the economic model by integrating cash at the heart of strategic ambitions.

Four Strategies Can Benefit From Using GMROI:

1 / The Categories Strategy

In order to put the cash dimension at the heart of the strategy, the GMROI can be used in the upstream construction of the category role matrix. The company thus ensures allocate resources and orient the sales mix towards the categories that generate the most cash

(linear spaces, promotional intensity, communication, etc.).

Failing to be able to integrate the GMROI as soon as the role matrix is built, it is possible to carry out a posteriori verification to ensure that the priority categories are not destroying cash.

2 / The Purchasing Strategy

We saw above that the GMROI is a great argument for negotiating with industrialists. Its use to improve purchasing policy can go much further.

Indeed, the GMROI can be used upstream to redefine the supplier base by contributing to the definition of thebest sourcing mix between the different production areas and importers. Thus, the GMROI allows arbitration for each type of product between local purchases, close area and large import.

3 / The Offer Strategy

Beyond the role matrix, the GMROI is also a very useful indicator in the supply strategy and in building the assortment itself.

Indeed, the GMROI gives quantitative indications on the sizing of the offer

(number of references per family) in addition to traditional competing benchmarks and analyzes of the number of units of need to be covered. The GMROI also allows decisions to be made on the construction of the triptych (PP / MDD / MN) and on the selection of references.

4 / The Supply Strategy

Finally, the GMROI has value in being integrated into all reflections concerning the Supply chain strategy.

Indeed, it helps to clarify the choices between the different options of logistics flows(stored / stretched / direct store) and help define and configure upstream (OMS) and downstream (re-stock / web) supplies.

Magnitude and Timing of the Impact

A program for integrating the GMROI into decision-making in matters of Offer, Purchasing and Supply chain generally improves the Free Cash Flow of the order of 3 to 6% of the current turnover excluding tax. A distributor who makes 1 billion euros in turnover excluding tax can therefore expect an improvement of € 30 million to € 60 million in his Free Cash Flow.

Half of this improvement is generally due to an improvement in the margin rate (from 2 to 4 pts) and a decrease in inventories (from 5 to 15%).

These significant gains can usually be captured over 2 years but the first results are felt in less than 3 months.

Plate 6 shows the summary and the schedule of the main short, medium and long term actions on each of the 3 major dimensions of the transformation: Supply, Purchasing and Supply chain.

GMROI can significantly improve performance because it is a tool that, beyond its analytical power, allows teams from different functions to align their goals and work together in the same direction.

Projects Integrating the GMROI Indicator

As the implementation of the indicator is not an objective in itself, most projects that include the GMROI indicator start with a first phase of setting up and calculating the indicator itself, then focus on the following phases to exploit the results of the calculation in the improvement of the business, whether it is the Category strategy, the construction of the Offer, the optimization of Purchases or the improvement in terms of Supply Chain.

A First Phase to Implement the Indicator

As mentioned earlier, the implementation of the indicator is generally not a problem and is limited to the time required for data collection. Nevertheless, some points must be mastered in order to define the relevant management rules for the calculation of the GMROI. In particular, the level of margin used for the calculation and valuation of stocks must be carefully defined.

Four Examples of Projects Integrating GMROI Into Business Decisions:

Role and Strategy of Categories

For a BtoB distribution brand: mapping of all categories and definition of their strategic roles.

Formalization of the strategic roadmap of 4 pilot categories and determination of the associated quantified ambitions (including GMROI).

Definition of the deployment plan across all categories and multi-business governance (Marketing / Purchasing / Supply / Sales / Finance).

Purchasing Optimization

For a specialized multi-brand group: global negotiation program with the TOP 100 suppliers based on a 360 ° assessment approach.

Integration into the process of several financial models including the GMROI, with very convincing results on purchasing gains in year 1.

Transformation of the Offer

For a specialized supermarket: plan to transform the offer in support of the brand’s new strategy aimed at reclaiming its market share in a context of severe cash flow constraints.

Integration of the GMROI indicator into the process to identify the required changes in offer, define the number of target references, select the most relevant references for the permanent assortment and the promotional dynamic.

Flow and Supply Optimization

For a GSA brand in Belgium: inventory optimization program for warehouses and stores leading to an overhaul of ordering processes.

Program integrating GMROI analysis in the initial diagnosis and in the identification of optimization priorities and ambitions.