Rationalizing an Innovation Portfolio to Gain in Efficiency

When to Consider Rationalizing the Research, Innovation & Development Portfolio

If your organization is facing one of the following six challenges, it is probably time to initiate a rationalization of your project portfolio.

Pain-Points

- You have little or no visibility on the projects in progress at a given time within your organization,

- It is difficult for you to compare your projects with each other on common and objective criteria,

- You do not know if you are leading the “right” projects and if the allocation of your human and financial resources is optimal.

Goals

- You need to save money and therefore focus your resources on projects with the best potential ROI,

- You want to secure projects that will guarantee growth in the medium and long term,

- You want to optimize your risks by having a balanced portfolio of projects.

Distinguish Between Portfolio Management and Project Management

Before diving into the subject of portfolio management itself, it is important to remember the difference between portfolio management and project management.

Portfolio management, schematically, comes down to making the right projects.

Project management, it’s about doing projects efficiently.

Establish a Virtuous Circle of Innovation

- Stop projects not aligned with the strategy or low impact.

- Concentrate teams and resources on the most relevant projects.

- Speed up the marketing of projects.

- Improve ROI and secure medium and long term growth.

The benchmarks carried out by the Inno practice of the KEPLER firm on the terms of Time-to-Market regularly show portfolio rationalization as an essential prerequisite for any approach aimed at accelerating time-to-market.

The Main Obstacles Encountered During the Implementation of an Innovation Portfolio Rationalization Process

- The lack of alignment between business, R&D and industry on projects,

- A vagueness in decision-making,

- A lack of centralized monitoring of projects (local storage, excel files, etc.),

- An inability to really stop projects (team impact, etc.).

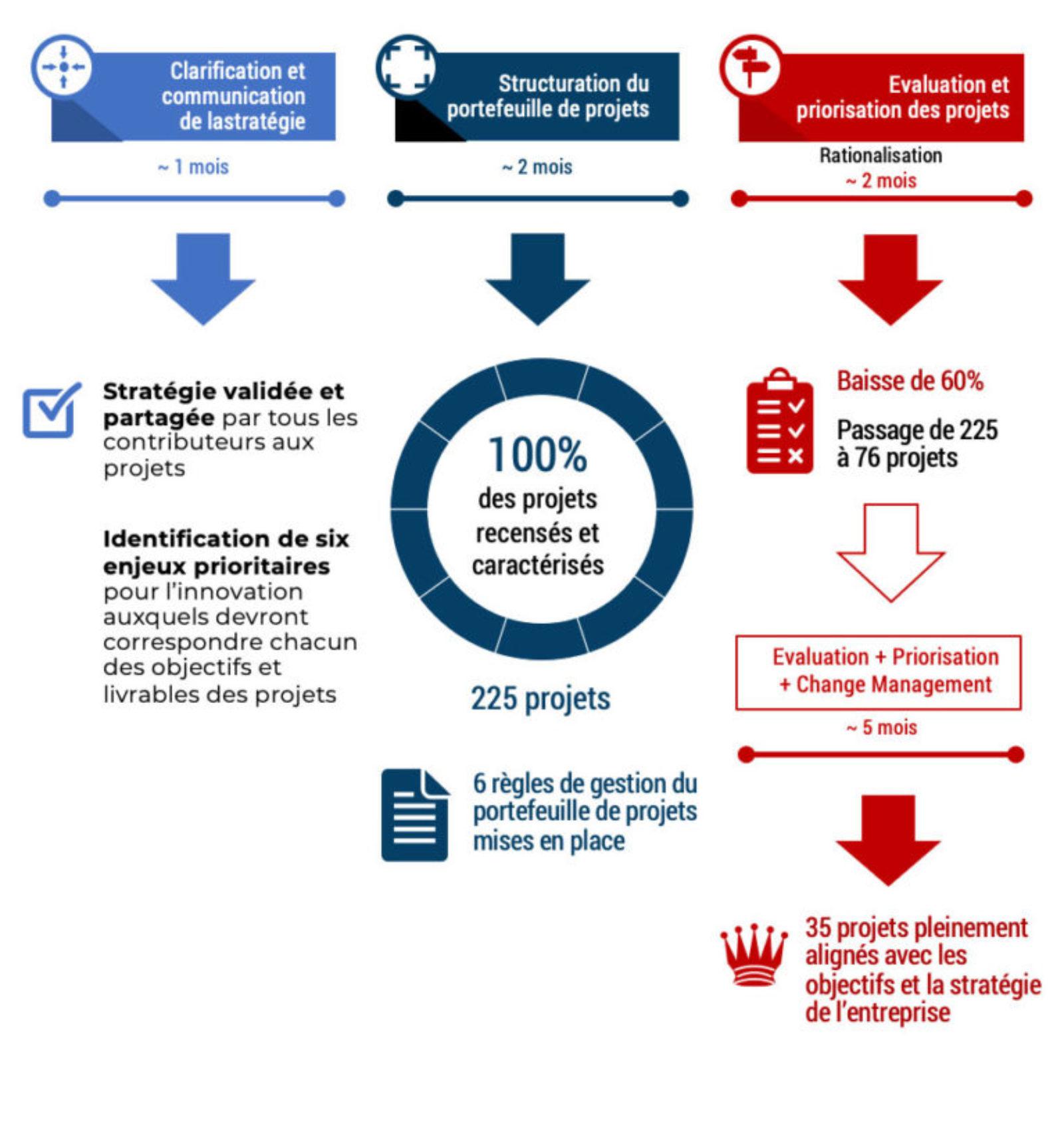

The Complete Process in Three Steps

Step 1: Clarification and Sharing of the Strategy

The whole organization should be aligned around three elements:

- A clear strategy for the whole organization. All stakeholders, whether it is management, marketing, R&D or even Industrial, are invited to share a common vision.

- A formulation of business and technological challenges to be addressed within R&D.

- A clear mandate of the roles and responsibilities of Research and Development to guarantee the proper implementation of this strategy.

Step 2: Structuring of the Project Portfolio

Alignment of all actors around the definition, typologies (research, knowledge or development projects, etc.) and the characterization of projects.

While this step seems trivial, it is in fact essential. It is important to remember here that a project to be fully implementable must include several essential data, among which: a deliverable, a team, a budget, a schedule (with a start and an end) and one or more clearly explained technical paths. .

A second, more refined prioritization, carried out with regard to the results of the scoring, but not only since all the exchanges with the various stakeholders and the company’s strategy must also be taken into account at this stage.

An exhaustive inventory of all R&D projects, which provides a complete portfolio of existing ones. We also make sure that all the players have been able to deliver their inputs.

The definition of clear management rules for the project portfolio. Ex: a maximum number of technical channels per project can be one of these management rules.

A review of all projects in compliance with new definitions and management rules for an “aligned” vision of the existing.

Step 3: Assessment and Prioritization of Projects

Closure of a first level of portfolio rationalization. At this stage, it is a question of examining the suitability of each project with the major issues mentioned in step 1:

- Does this project meet the defined criteria?

- Is there a specific reason for keeping it?

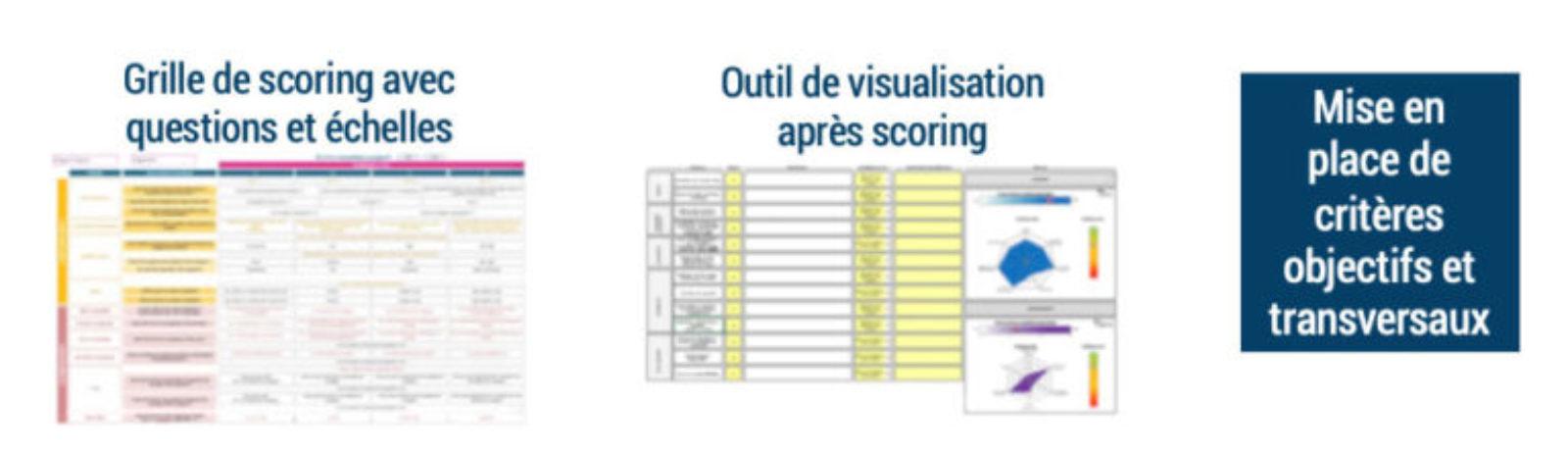

Tooling for the prioritization process via a scoring grid with the most objectivable criteria possible: business potential, feasibility, deadlines, etc.

Scorings as we understand them are not “expert” systems but rather reading grids allowing discussion to be initiated around criteria to be defined collectively.

Scoring of each of the projects in the portfolio, which provides a comparison of these projects within different scopes but also across the entire organization.

Prioritization using the results of the scoring and on the basis of discussions between the various stakeholders. This second component makes it possible both to guarantee a more effective notching of the methodology, but also an evolution of the “mindset” internally, with the taking into account of each person’s priorities when launching a new project.

Reallocation of resources in line with the new prioritization of projects.

Example of a Customer Case in the Industrial Sector

Focus on the Finalization Stage of the Project

The stage of finalizing the prioritization of projects takes hold a little longer. Indeed, at this stage, the effort is primarily focused on Change Management. The challenge is to ensure real ownership and proper handling of the portfolio by operational staff: integration of the structuring, proper application of management rules and use of tools over time.

The 60% reduction in the number of projects that appears following the completion of the first level of rationalization does not mean the stricto sensu elimination of 150 projects.

In fact, the portfolio is reworked with all the contributors, with the key, project mergers in the case where the deliverables and objectives are close and in others enlarged project perimeters and encompassing several in order to gain in impact on a given deliverable.

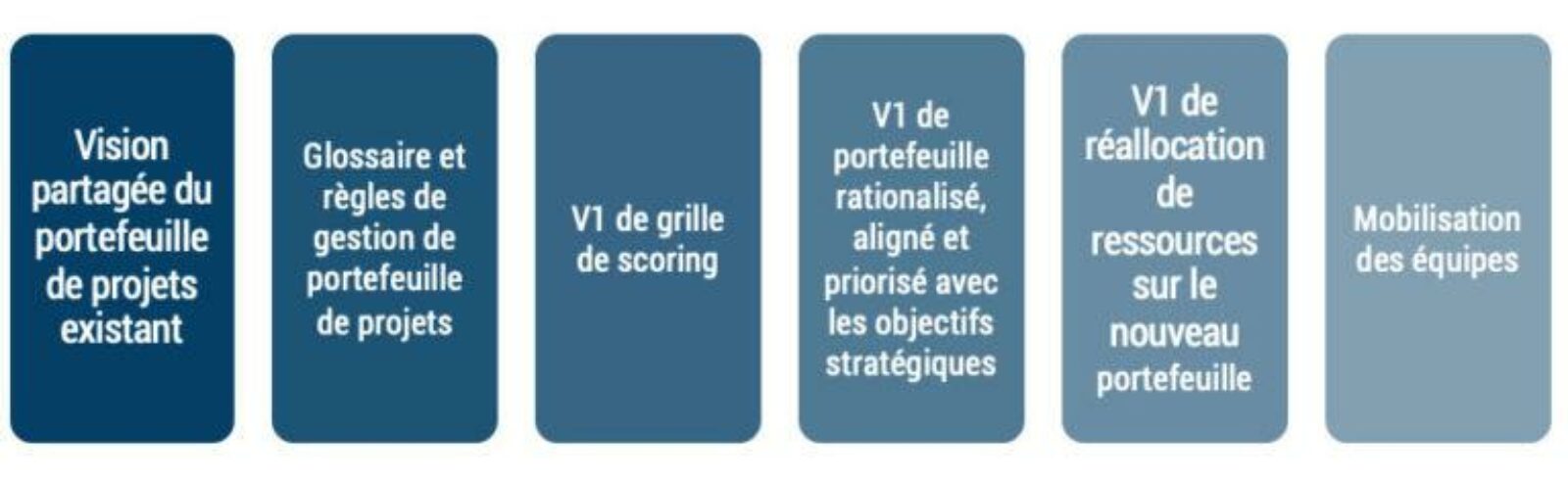

Examples of Deliverables Obtained at the End of the Mission

The possibility of an "accelerated" or Pilot approach

A Concentrate of the Complete Process for Almost Immediate Results

KEPLER Smart Value Initiatives: Background Reminder

In today’s environment, companies are looking for quick action to preserve cash flow and limit the impact on EBIT.

Based on its expertise and proven results during client missions, KEPLER has defined 9 “Smart Value Initiatives” which make it possible to:

- Generate rapid impacts on the business,

- Without preempting the future (non-destructive approaches),

- Initiate the transformation towards more resilient and agile models,

- Endow organizations with innovative tools and technologies.

Deliverables Expected at the End of the “Fast-Track” Method

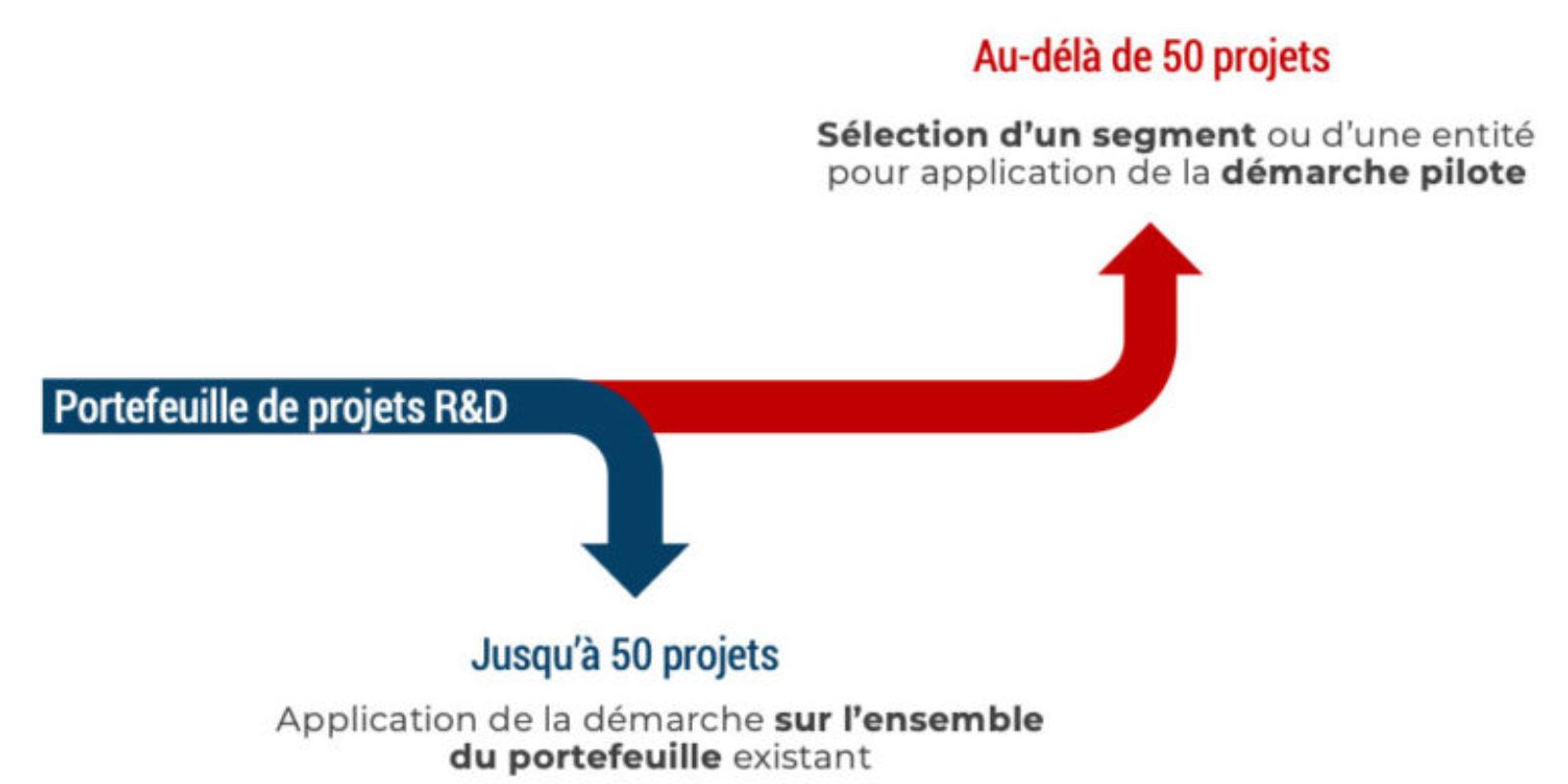

Flash Method Eligibility Conditions

Four key Success Factors

Valid for a Classic Approach and Essential for an “Accelerated” Approach

Benefits at the End of the Process

Possible Changes in the Pursuit of its Transformation Depending on the Maturity of its Organization and its Portfolio Management